News Details

NEWS

Contact us

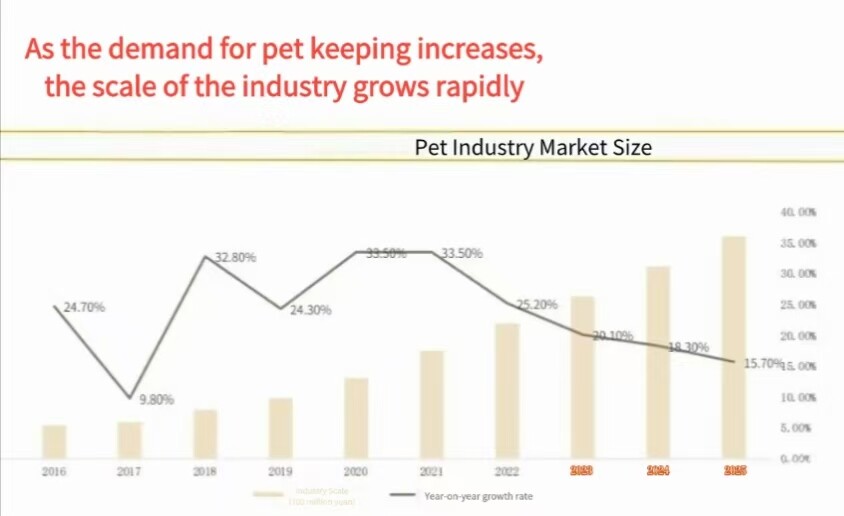

At GoldenHour Innova Co.,Ltd, we are committed to providing innovative pet products. As we explore the pet industry landscape, we aim to share valuable insights with our customers and followers. Recently, KPMG China released the "2025 China Pet Industry Market Report - Consumption Upgrades and Market Insights in the 'Pet Economy'", which offers a comprehensive view of the industry, and we'll also delve into the global trends.

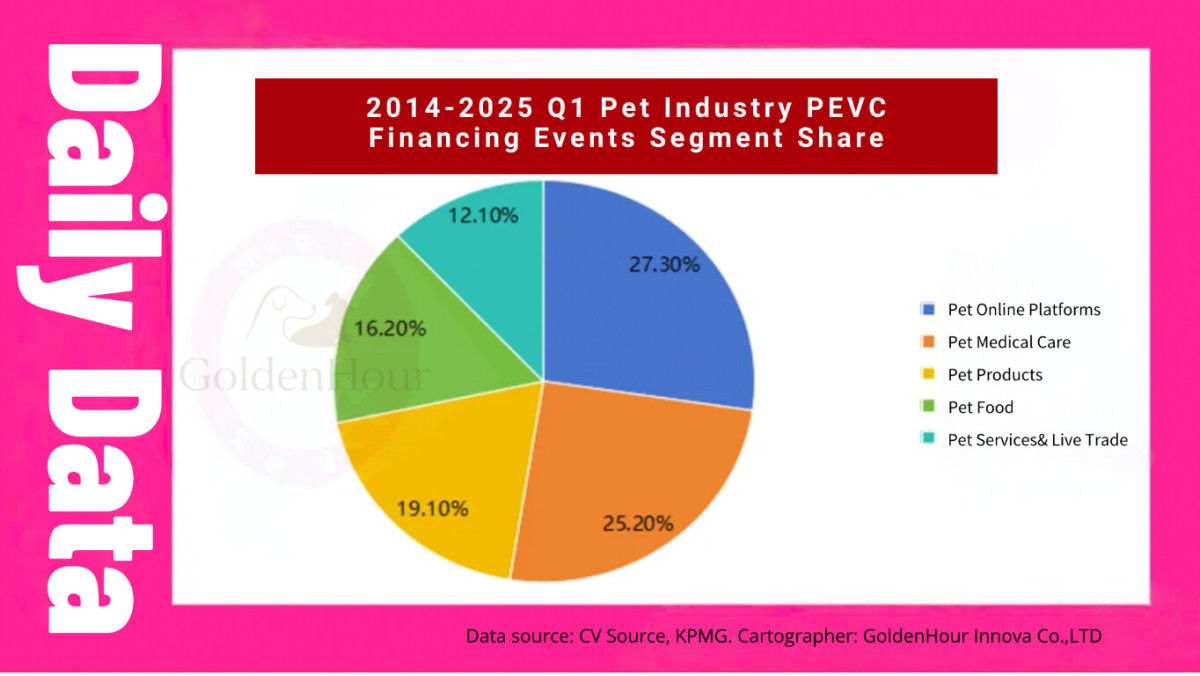

1. Financing Landscape in Sub - sectors

This financing boom has covered multiple key links in the pet industry chain, from mature areas like supply chain integrators, traditional food and daily necessities manufacturers, to emerging fields such as biopharmaceutical R & D, e - commerce platforms, and smart hardware development. Capital is also accelerating its layout in frontier tracks such as pet cultural and entertainment supplies, artificial intelligence and big data applications, information management system development, and pet financial innovation services, promoting the industry's evolution towards digitalization and specialization. Our own smart pet products, such as smart feeders and water fountains, are part of this innovative trend in the pet supplies sector, integrating advanced technology to meet the needs of modern pet owners.

2. Fluctuations in the Financing Market

2.1 Financing Quantity Trends

From 2014 to 2025, the financing events in the pet industry generally showed a trend of first rising and then falling, with obvious cyclical fluctuations. The period from 2014 to 2018 was a rapid growth stage, with a total of 289 PE/VC financing events. The number of financing events increased from 25 in 2014 to a peak of 81 in 2018, with an average annual compound growth rate of about 34.2%. From 2019 to 2021, it entered a prosperous development stage, with an average of over 70 financing cases per year. In 2022, it entered a capital cooling - off period, and the number of financing events decreased significantly. In 2024, there were only 29 cases, basically returning to the level of a decade ago. In the first quarter of this year, only about 6 financing events occurred. The number of financing for the whole year is expected to remain low or experience a slight recovery, depending on the recovery of capital attractiveness in emerging tracks such as pet medical innovation and smart pet devices.

2.2 Financing Amount Trends

In terms of financing scale, the investment and financing in the Chinese pet industry have shown a significant hierarchical leap. In the early stage from 2014 - 2017, single - financing was mostly in the million - yuan range. In 2018, the number of multi - million - yuan financing cases exceeded that of million - yuan cases for the first time, marking the industry's entry into a large - scale development stage. Although the activity of industry investment and financing has declined since 2021, the quality of financing has shown structural optimization. The current market is characterized by "total volume contraction and quality improvement", with the proportion of medium - and large - scale financing cases of tens of millions of yuan and above continuously increasing. In the past two years, there have still been about 5 single - financing cases of over 100 million yuan per year on average, indicating that capital has not completely withdrawn but has concentrated on leading enterprises.

3. Global Pet Industry Development Trends

In the pet healthcare sector, innovation is a key driver. The global pet pharmaceutical market is predicted to grow from the current 16 billion to 25 billion by 2030. New therapies like monoclonal antibodies are becoming more common, and the demand for high - end preventive healthcare and diagnostic services is on the rise, with an estimated market value of $30 billion by 2030.

3.2 Rise of E - commerce and Social Media Influence

Emerging markets like China are experiencing rapid growth. With the acceleration of urbanization and the increase in disposable income, China's pet market is expected to exceed $49 billion by 2030, becoming a major growth engine for the global pet economy.

3.4 Technological Innovations in the Pet Industry

Artificial intelligence and big data will also play a crucial role in providing personalized pet care services. For example, AI can analyze pet health data to create customized health management plans, which will further drive the development of the high - end pet care and nutrition management markets. At GoldenHour Innova Co.,Ltd, we strive to incorporate these advanced technologies into our smart pet products, providing pet owners with more convenient and intelligent pet - raising solutions.

In conclusion, the global pet industry, including the Chinese market, is full of opportunities. Whether in developed or emerging markets, trends such as premiumization, personalization, and technology - driven development will continue to shape the industry's future. As a company in the pet product field, GoldenHour Innova Co.,Ltd will keep an eye on these trends and continuously innovate to meet the evolving needs of pet owners worldwide.